Contents:

Students turn out to be familiar with current financial crime tendencies and prevention challenges. They are able to critically evaluate insurance policies and practices that result in fraudulent and criminal behaviors. Courses on monetary crime management and danger management practice college students to detect and deter anti-money laundering crimes by implementing processes and technology that minimizes dangers. Anti-cash laundering specialists examine potential cash laundering risks in banks and financial institutions.

This includes an active screening of customers and transactions through potent processes and reporting procedures. They require a comprehensive and integrated AML-KYC lifecycle management that provides an accurate and total view of risks and vulnerabilities. Advanced analytics can slash the cost of fighting financial crime across the enterprise. The program mainly focuses on the threat, crime and fraudulent activities involved in handling funds and customers. Transaction monitoring analyst monitors and reviews account transactions to ensure appropriateness. Financial organizations use anti-cash laundering specialists as auditors and compliance brokers.

- The country is also home to global operations of major financial and non-financial institutions that undertake their global AML operations due to availability of highly qualified and trained AML compliance professionals.

- That’s why CAMS is the only certification that is globally recognized as the standard for Anti-money laundering certification.

- This course covers Money Laundering and Terrorist Financing Regulations, Economic Sanctions, and Politically Exposed Persons.

- In India, These are the top companies that hired Certified Anti-Money Laundering Specialists .

- Anti-money laundering specialist are financial risk and compliance specialists who defend assets and forestall crimes.

They monitor inside and external people and businesses for suspicious financial activities. CAMS certification is the only certification for those aspirants who want to be anti-money laundering experts or Professionals. By passing the CAMS exam, candidates will increase their skill and knowledge and help to protect and prevent Money-laundering crimes of the Company. Candidates who want to be anti-money laundering experts must have expert approval.

Roles of Money Laundering Reporting Officer MLRO (AML CFT) (Udemy)

At present, most of the international locations’ regulatory our bodies are placing larger emphasis on anti-cash laundering and counter-terrorism measures. Kevin Gulledge brings over a decade of retail banking expertise to Abrigo, having labored with mid-sized and huge worldwide institutions in a wide range of roles, together with retail, operations, compliance, and BSA/AML. It’s as much as monetary institutions to monitor their customers’ deposits and other transactions to ensure they are not a part of a money-laundering scheme. The institutions must confirm the place giant sums of money originated, monitor suspicious activities, and report money transactions exceeding $10,000. If this sounds like you, you may be a fantastic fit for a job as an Anti-Money Laundering Analyst.

On the other hand, you will be shocked, any non-certified Anti-Money Laundering professionals can also earn between $50K to $ 60K per year. Second, Any financial professional certificate can help to add an extra 10 credits for each accreditation, including certificates such as, CFE, or CPA. Learn how to stand out from the crowd and show employers and clients your actual skill by taking this Anti Money Laundering Online Course.

Looking for best CAMS Certification training courses in Dubai?

For that reason, the individual signing the form should be familiar with the applicant’s experience, performance, and skills abilities and confident that the applicant meets all the requirements as noted on the form. Understanding the laws and regulations applicable to regulated financial institutions and money service businesses. We are a diverse group of professionals from various industries and career stages, including consultants, entrepreneurs, strategic professionals, and administrators.

There is a choose quantity of faculties that supply master’s levels in monetary audits, cams anti money launderings and compliance. CFE is beneficial for those who want to pursue a career as a fraud investigator. That’s why CAMS is the only certification that is globally recognized as the standard for Anti-money laundering certification.

We bring 21st century education for working professionals from the premium Institutions to move to the next level. Try another search query or take our salary survey to get a personalized salary report for your job title. By clicking submit below, You consent to allow Delphi Team to communicate via email, WhatsApp or Call regarding the certification courses. You will also receive a printed score report at the test center, and it will be emailed to you shortly after your examination. This email will state your exam results and how to maintain the certification up to date. Our faculties are qualified & industry experts with significant experience in their domain.

Vskills’ Certified AML-KYC Compliance Officer

The following lectures will discuss Anti-Money Laundering regulations, KYC methods, Economic Sanctions, and Politically Compromised Individuals. Many professors from Asia’s top business schools, as well as industry specialists, contribute to the book. Many compliance officers told me about CAMS, and after finishing it, they received salary raises and reviews.

Our progressive technology and flexible service offerings help organisations manage financial crime risk in a cost-effective and sustainable manner. An Anti-Money Laundering Specialist is a professional who is committed to a financial system in protecting it against money laundering. An AML specialist is also responsible for looking out for, scrutinizing, and reporting any kind of financial transactions that are deemed suspicious. The professional association serves to provide specialized training and certification for anti-money laundering professionals. CAMS certification keeps AML professionals interested in new trends and up-to-date.

David Stewart leads strategy development, drives product management and provides key marketing counsel for fraud and compliance solutions worldwide. In addition to working closely with many of the world’s leading financial institutions and regulatory agencies, Stewart collaborates with SAS R&D and delivery teams to deploy industry best practices for financial crimes solutions. Beth Herron has more than seven years of experience supporting the financial crimes space, specializing in anti-money laundering analytics, detection strategies and case management. She leads a team of subject-matter experts who support financial institutions with pre- and post-sales support. Prior to joining SAS, she worked within the financial intelligence unit of a top five global financial institution.

From the world’s leading membership association, ACAMS provides this certification which is used in financial institutions, governments, and regulators to protect financial systems against money laundering. The certification is aimed at enhancing the quality of compliance with the directions of RBI in combating illegal operations and movement of funds through the use of banking channels. KYC and Anti Money Laundering operations have assumed added importance owing to the security risk that it poses to the country, and also to maintain the financial health of the institutions. Anti-money Laundering services Money laundering, drug trafficking and terrorist financing are the lifeblood of transnational crimes. KPMG in India has set – up a modern Offshore Delivery Centre , which is capable of delivering AML services through its top – notch data secure environment in an efficient manner across different time zones.

We’ve recently updated our security measures to make iimhttps://1investing.in/.com safer and more secure for you. Desertcart provides a seamless and secure shopping platform with 100 million+ products from around the globe delivered to your door. She shares insights in her various experiences in handling Compliance Processes. In India, These are the top companies that hired Certified Anti-Money Laundering Specialists . If you are a CAMS certification holder, it will be a great chance for you to be placed in a good organization with a high package.

- In this crucial era, when theft and fraud are frequent, it has become essential for banks, insurance companies and various other Non-banking financial institutions – NBFCs to have detailed information of their customers.

- IiMARK is a leading EdTech organization started by IIM Ahmedabad Alumni group serving skill level education for working professionals and the corporates.

- From the world’s leading membership association, ACAMS provides this certification which is used in financial institutions, governments, and regulators to protect financial systems against money laundering.

- In addition, You can need references along with credit proof from 3 professionals.

- Furthermore, The Financial Action Task Force has issued advice for its members to improve their anti-money laundering and counter-terrorist financing legislation and systems.

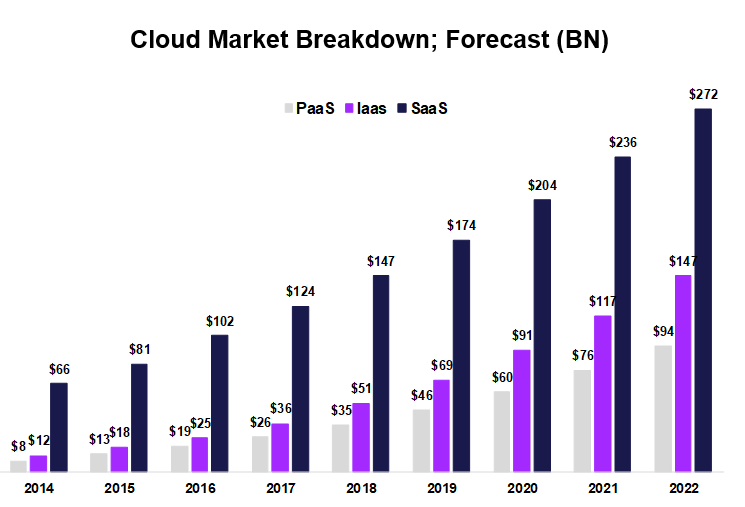

ML enables professionals to focus on valuable, complex activities – not every alert. Statistics about size of industry, untapped professional opportunities, list of experts in subject area, etc. The alternative is to make use of the money from illicit actions to set up entrance corporations. This permits the funds from illicit activities to be obscured in authorized transactions. The reason for this is that governments have realized that, in order for the criminal actions to foster, the illegal money ought to move smoothly between actors involved in unethical acts.

Global Offices

You need to have a clear understanding of the value and structure of the data provided. Having analytical skills makes their job easier and problem-solving skills will be an added advantage. With multiple options, aspirants could comfortably compile the necessary points. Several certification courses carry a significant number of points so choosing them carefully will earn you enough points. Money Market Analyst, the AML specialist is a smaller group of 20k individuals across the globe.

Location, Location, Location and 2022 in Review – ACAMS Today

Location, Location, Location and 2022 in Review.

Posted: Fri, 10 Mar 2023 08:00:00 GMT [source]

To be eligible to be such a specialist, one must clear the certification- Certified Anti-Money Laundering Specialist . But this certification course is the last lap of a series of academic and certification courses. IiMARK is a leading EdTech organization started by IIM Ahmedabad Alumni group serving skill level education for working professionals and the corporates.

Rūta Bajarūnaitė: A Visionary for the Future of AML in Lithuania – ACAMS Today

Rūta Bajarūnaitė: A Visionary for the Future of AML in Lithuania.

Posted: Tue, 07 Mar 2023 08:00:00 GMT [source]

The suspicious activities need to be reported, and the proper record must be maintained at all times in all such cases. He is a Certified Anti-Money Laundering Specialist and has more than 19 years of experience in the financial services industry. First of all, Aspirants must earn at least 40 credits for their college coursework.

Leave a Reply