Content

Last but not least, we’ve arrived at the revenue accounts. Your income accounts track incoming money, both from operations and non-operations. Remember that debits increase your expenses, and credits decrease expense accounts. An example of an Expense account would be a typical business expense, such as your rent payment on a physical business location. If you pay $1000 in rent from your checking account, you would then credit your checking account and debit your Expense sub-account, in this case, a rent Expense account. What’s more, it’s the difference between the separate accounts of your assets and liabilities.

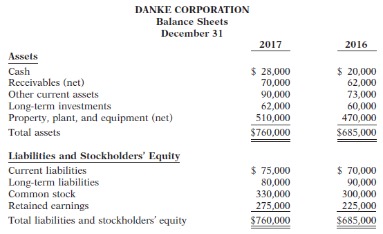

Liabilities accounts include the debts and money owed, such as loan payments, bills, and orders owed to customers. Current liabilities are those that are owed or due within the current year, such as rent payments or utilities. Noncurrent liabilities are debts that are not owed within the current period, such as deferred loan payments. Think of a checking account as your “everyday account.” It’s a place to keep the money you use to pay your bills or cover everyday expenses.

Accounts Payable

Brokerage accounts are considered higher risk because the value of your stocks can go down, meaning that you could lose money if you sell them at that lower price. But brokerage accounts also have the greatest potential to grow over the long haul. So if you want to earn the most you can with your money and you can afford to take the risk, a brokerage account might be right for you. This type of account is used to keep track of all types of business income sources. Remember to review your bank account features and costs regularly. And if your needs change, consider making the switch to a new bank if you can find a better option elsewhere.

This account is made when earning is received but services are not given. So, this account is very helpful to track the amount which is taken advance before giving services. The Principle of Duality is the basis of financial accounting.

Types of Account

It complies with the rules and policies of the company’s Internal Revenue Code. Best money market accounts, though, have low to no minimums and no monthly fees. Savings accounts also tend to have monthly fees of $5 or more if you https://kelleysbookkeeping.com/ don’t meet certain requirements, such as keeping a minimum daily balance. And if your credit card gets hit with a fraudulent charge, your maximum liability for those charges is less than it is for unauthorized debit card charges.

- In simple words, it is a type of accounting that is suitable only for legal proceedings.

- At Mid Penn Bank, our savings accounts have no minimum balance fees, no monthly maintenance charges, and no fees for transfers to other Mid Penn Bank accounts.

- Once you understand how debits and credits affect the above real accounts, it will be easier to determine where to place your sub-accounts.

- Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you.

- An expense account represents a category of expenses for the business.

- You should be able to complete the account type column and some of the account descriptions.

It is important to note that First Republic does not provide tax or legal advice. This information is provided to you as is, is not legal advice, is governed by our Terms and Conditions of Use, and we are not acting as your attorney or tax advisor. We make no claims, promises or guarantees about the accuracy, completeness, Types Of Accounts or adequacy of the information herein. Clients’ tax and legal affairs are their own responsibility. Clients should consult their own attorneys or tax advisors in order to understand the tax and legal consequences of any strategies mentioned herein. Get the curated financial guidance you need with our monthly newsletter.

Leave a Reply